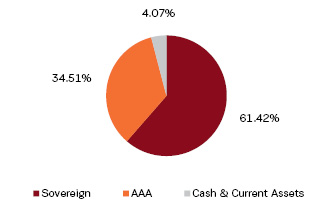

| Portfolio Holdings |

| Issuer |

% to net Assets |

Rating |

| State Government bond |

57.92% |

|

| 6.03% RAJASTHAN 11MAR2025 SDL |

7.90% |

SOV |

| 6.69% MADHYA PRADESH 17MAR25 SDL |

6.44% |

SOV |

| 8.05% HARYANA 25FEB2025 SDL |

5.98% |

SOV |

| 8.08% UTTAR PRADESH 25FEB25 SDL |

5.44% |

SOV |

| KARNATAKA 8.06% 11FEB25 SDL |

5.43% |

SOV |

| 8.09% ANDHRA PRADESH 28JAN2025 SDL |

5.43% |

SOV |

| 8.07% TAMIL NADU 28JAN25 SDL |

5.43% |

SOV |

| 8.06% MAHARASHTRA 11FEB2025 SDL |

5.32% |

SOV |

| 8.08% HARYANA 28JAN2025 SDL |

3.80% |

SOV |

| 8.06% ANDHRA PRADESH 25FEB25 SDL |

1.63% |

SOV |

| 8.04% HARYANA 25MAR2025 SDL |

1.36% |

SOV |

| 8.05% MAHARASHTRA 28JAN2025 SDL |

0.81% |

SOV |

| 8.08% WEST BENGAL 29APR2025 SDL |

0.54% |

SOV |

| 8.08% BIHAR 28JAN2025 SDL |

0.54% |

SOV |

| 8.10% UTTAR PRADESH 28JAN2025 SDL |

0.51% |

SOV |

| 8.10% ANDHRA PRADESH 11MAR2025 SDL |

0.27% |

SOV |

| 8.12% TELANGANA 11MAR2025 SDL |

0.27% |

SOV |

| 8.08% MADHYA PRADESH 11FEB2025 SDL |

0.27% |

SOV |

| KARNATAKA 8.05% 25FEB25 SDL |

0.27% |

SOV |

| GUJARAT 8.05% 25FEB25 SDL |

0.27% |

SOV |

| Fixed rates bonds - Corporate |

34.51% |

|

| National Bank For Agriculture and Rural Development |

12.96% |

ICRA AAA |

| Small Industries Development Bank of India |

7.81% |

ICRA AAA |

| REC Limited |

5.43% |

CRISIL AAA |

| REC Limited |

2.71% |

ICRA AAA |

| Small Industries Development Bank of India |

2.60% |

CARE AAA |

| Power Grid Corporation of India Limited |

2.17% |

ICRA AAA |

| Export Import Bank of India |

0.81% |

CRISIL AAA |

| Cash Management Bills |

3.50% |

|

| Government of India |

2.10% |

SOV |

| Government of India |

1.26% |

SOV |

| Government of India |

0.15% |

SOV |

| Cash & Current Assets |

4.07% |

|

| Total Net Assets |

100.00% |

|